Myths and misconceptions about insurance car repairs are rampant, leading to confusion and sometimes costly mistakes. This blog aims to clarify and provide insight into some of the most common car insurance myths and facts.

Common Myths Debunked:

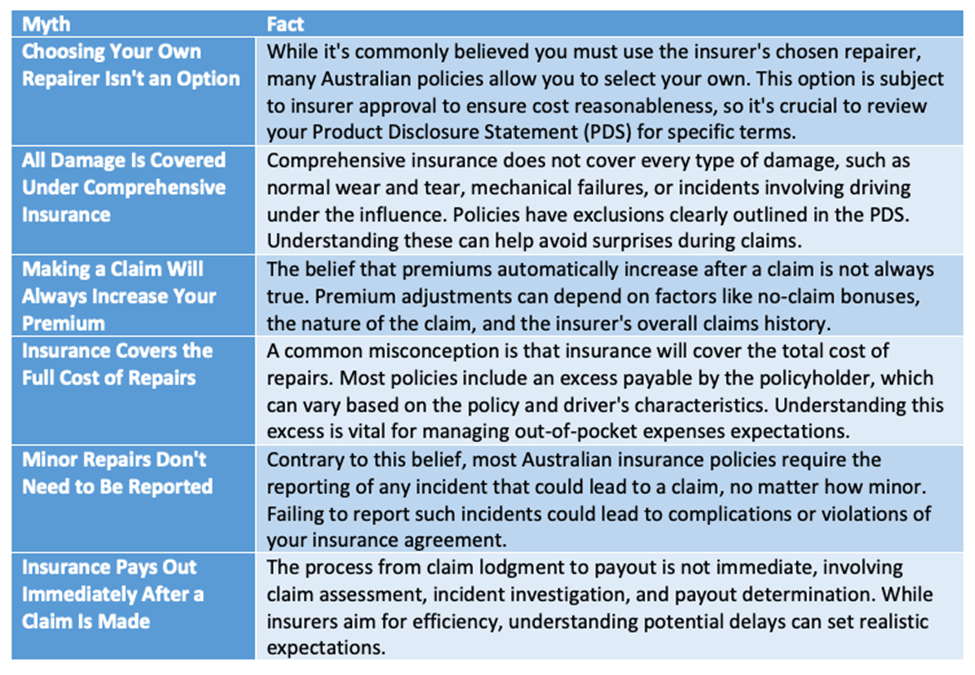

Myth 1: Choosing Your Own Repairer Isn’t an Option

One widespread misconception is that policyholders must use the repairer their insurance company chooses for them. However, many Australian insurers offer the option to select your own repairer, although this can depend on the specific policy terms. It’s essential to read your Product Disclosure Statement (PDS) carefully to understand your rights. Opting for an insurance repair for cars from a repairer you trust can lead to more satisfactory repair work, though it’s worth noting that the insurer may still need to approve the repairer to ensure the costs are reasonable.

Myth 2: All Damage Is Covered Under Comprehensive Insurance

While comprehensive car insurance offers the most extensive coverage, it doesn’t necessarily cover every type of damage. Normal wear and tear, mechanical failures, and damage caused by driving under the influence are typically not covered. Each policy has exclusions, which are clearly outlined in the PDS. Understanding these exclusions can prevent unexpected surprises when it comes time to claim.

Myth 3: Making a Claim Will Always Increase Your Premium

Another common myth is that your insurance premium will automatically increase if you make a claim. While it’s true that your claims history can impact your premium, it’s not a given that it will rise after making a claim. Factors such as your no-claim bonus, the nature of the claim, and the overall claims history of all policyholders within the insurance pool can influence premium adjustments.

Myth 4: Insurance Covers the Full Cost of Repairs

Many people believe that car insurance will cover the total cost of any repairs after an accident. However, most policies require the policyholder to pay an excess, which is a fixed amount towards the repair cost. The excess amount varies depending on the policy and sometimes the driver’s age or experience. Understanding the excess payable can help manage expectations regarding out-of-pocket expenses in the event of a claim.

Myth 5: Minor Repairs Don’t Need to Be Reported

Failing to report minor damage or small accidents can backfire. Most insurance policies in Australia require policyholders to report any incident that could lead to a claim, regardless of the damage’s extent. Not reporting such incidents could violate your insurance agreement, potentially leading to difficulties if a more significant claim is made later on.

Myth 6: Insurance Pays Out Immediately After a Claim Is Made

The belief that insurance companies pay out immediately after a claim is lodged is another myth. The claims process can take time as it involves assessing the claim, investigating the incident, and determining the payout amount. While insurers strive to process claims efficiently, understanding that there may be delays can help set realistic expectations.

End Note

Dispelling common car insurance myths is crucial for making informed decisions and managing expectations. Knowing the facts can empower drivers to choose the right coverage, understand the claims process, and navigate the complexities of car insurance with confidence.